Mastering Financial Stability: The Key to a Stress-Free Future

Managing personal finances is a crucial skill that many struggle to master. Without proper planning, it becomes easy to overspend, leading to financial stress and uncertainty. The key to achieving financial security lies in using an effective Monthly Budget Planner that helps track income, expenses, and savings. Budgeting is not just about restricting spending but ensuring that financial goals align with earnings and lifestyle needs. A well-structured plan provides clarity, making it easier to prioritize essentials while still setting aside funds for future aspirations.

A Monthly Budget Planner serves as a roadmap to achieving financial goals. It provides a clear picture of income sources and expenditures, helping individuals identify areas where spending can be reduced. With a structured approach, it becomes easier to allocate funds efficiently and avoid unnecessary financial strain. Many people struggle with unexpected expenses that can throw their budget off balance. By planning ahead and setting aside an emergency fund, financial stability becomes more attainable. This method allows individuals to make informed decisions, reducing financial anxiety and fostering a sense of control over money matters.

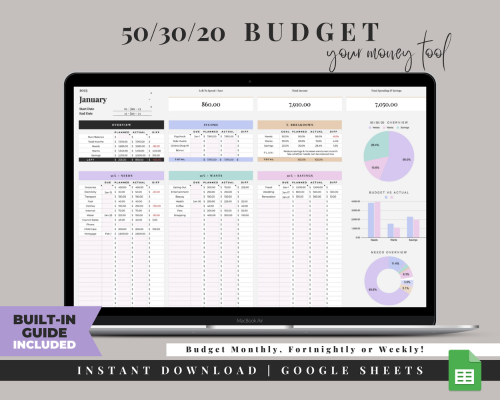

Effective budgeting is not about eliminating enjoyable activities but making smarter financial choices. A well-organized Monthly Budget Spreadsheet enables better money management by categorizing expenses and tracking financial progress. By consistently updating and reviewing the spreadsheet, individuals gain valuable insights into spending patterns. It becomes easier to determine where adjustments can be made to increase savings. This level of financial awareness promotes responsible spending habits, ensuring that financial objectives remain within reach. Proper budgeting fosters financial discipline, making it easier to prepare for major life events without unnecessary financial burdens.

Long-term financial success depends on consistent planning and realistic goal-setting. A Monthly Budget Spreadsheet simplifies the process by offering a visual representation of financial inflows and outflows. It becomes easier to identify spending trends and make necessary adjustments to maintain financial balance. Unexpected expenses often pose a challenge, but with a well-maintained budget, financial disruptions can be minimized. By analyzing spending habits regularly, individuals can make better financial choices, leading to improved savings and a more secure future. Financial stability is achievable with disciplined planning and the right tools.

The journey towards financial independence begins with smart money management practices. A structured budgeting approach eliminates guesswork and provides clarity on financial priorities. Utilizing resources like a Monthly Budget Planner or a Monthly Budget Spreadsheet transforms financial management into a streamlined process. These tools empower individuals to take charge of their finances, ensuring they remain on track with their goals. With dedication and consistency, financial freedom becomes a reality. For those looking for effective budgeting solutions, platforms like Thriving Koala offer valuable resources to simplify money management and create a more secure financial future.

For more info : - Monthly Budget Template

Comments

Post a Comment